With the recent volatility in the stock market…

You might be weighing a Roth IRA conversion. Of course, you are responsible for paying income tax on the conversion from a traditional IRA to a Roth IRA for the year you do the switch. But once the money is in the Roth, you can take contributions at any time. And distributions of earnings are free of income tax, provided you’re 59½ or older when you take the payout, and at least five years have passed from the year that you first put funds in any Roth IRA you own, either by contribution or through a Roth conversion.

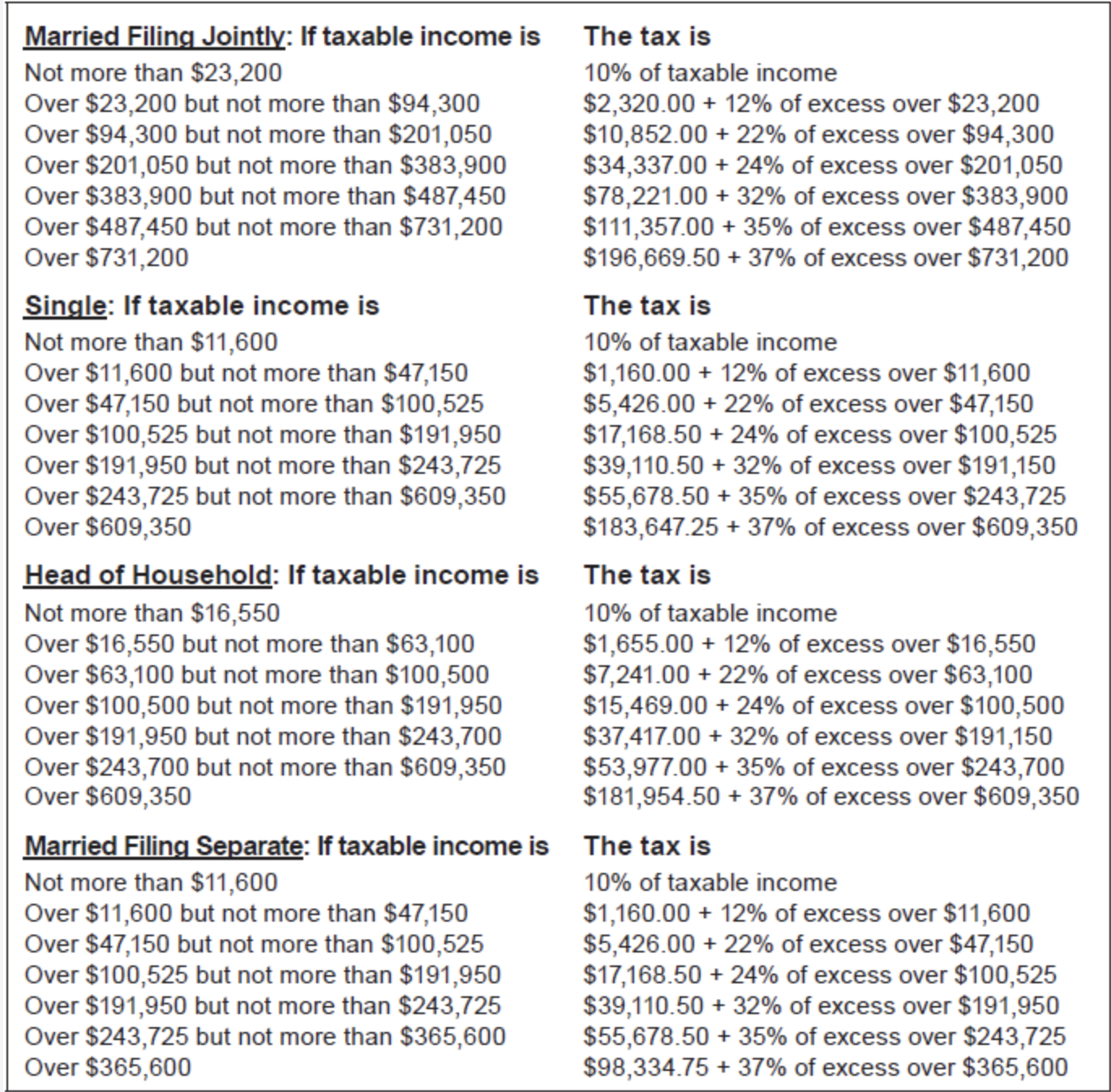

Present and future income tax rates are key to deciding on a Roth conversion.

If you expect the rate you’ll pay in retirement will be equal to or higher than the rate on conversion, then switching to a Roth IRA can pay off taxwise. If your tax rate in retirement will be lower, then tax-free Roth distributions are less advantageous. Federal income tax rates are low right now, and we think they’ll stay low for a while. Although the lower rates enacted in late 2017 are set to expire at the end of this year, it’s widely thought that President Trump and congressional GOPers will extend them. We have heard some rumbling about a higher federal income tax rate of 40% or so for millionaires, but it’s too soon to know whether this tax hike will come to fruition.

If you do a conversion, don’t tap IRA funds to pay the tax on converted funds.

A Roth conversion is treated as a taxable distribution to you followed by a contribution of those funds to the Roth. The IRA custodian will by default withhold 10% federal tax from the converted funds. This withheld amount is treated as a distribution to you on which you have to pay tax, in addition to the funds that you move to the Roth. That is why experts advise paying tax owed on a Roth conversion with non-IRA funds and requesting that the custodian withhold 0% from the converted IRA money.

Let’s turn to other factors to consider when pondering a Roth IRA conversion.

You don’t need to convert all the funds in your traditional IRA at one time. You can do conversions in increments over time, and space out the income tax hit. Conversions can ease the pain of the 10-year clean-out rule for inherited IRAs. Beneficiaries of inherited Roths would have to empty the accounts within 10 years. But the money would be tax-free to them, unlike beneficiaries of traditional IRAs. Converting can pay off if you expect your IRA assets will soar in value. The same rationale applies if you have IRA assets that now are depressed in value. The additional income from converting can trigger higher Medicare premiums. Individuals with 2023 modified adjusted gross incomes over $212,000 for joint filers and $106,000 for singles pay a monthly surcharge in 2025 for Parts B and D coverage on top of their regular premiums. These figures will be somewhat higher for 2025 MAGI, used for figuring 2027 monthly Medicare premium surcharges. Income from converting from a traditional IRA to a Roth IRA is included in the calculation of MAGI. If you’re subject to required minimum distributions from your traditional IRA… You must take your annual RMD from it in the year of the Roth conversion.