PAYROLL TAXES

The Social Security annual wage base for 2024 is $168,600, an $8,400 hike. The Social Security tax rate on employers and employees remains 6.2%. Both pay the 1.45% Medicare tax on all compensation, with no cap. Individuals also pay an additional 0.9% Medicare surtax on wages and self-employment income over $200,000 for singles and $250,000 for couples. The surtax doesn’t hit employers.

The nanny tax threshold is $2,700 for 2024, a $100 increase from 2023.

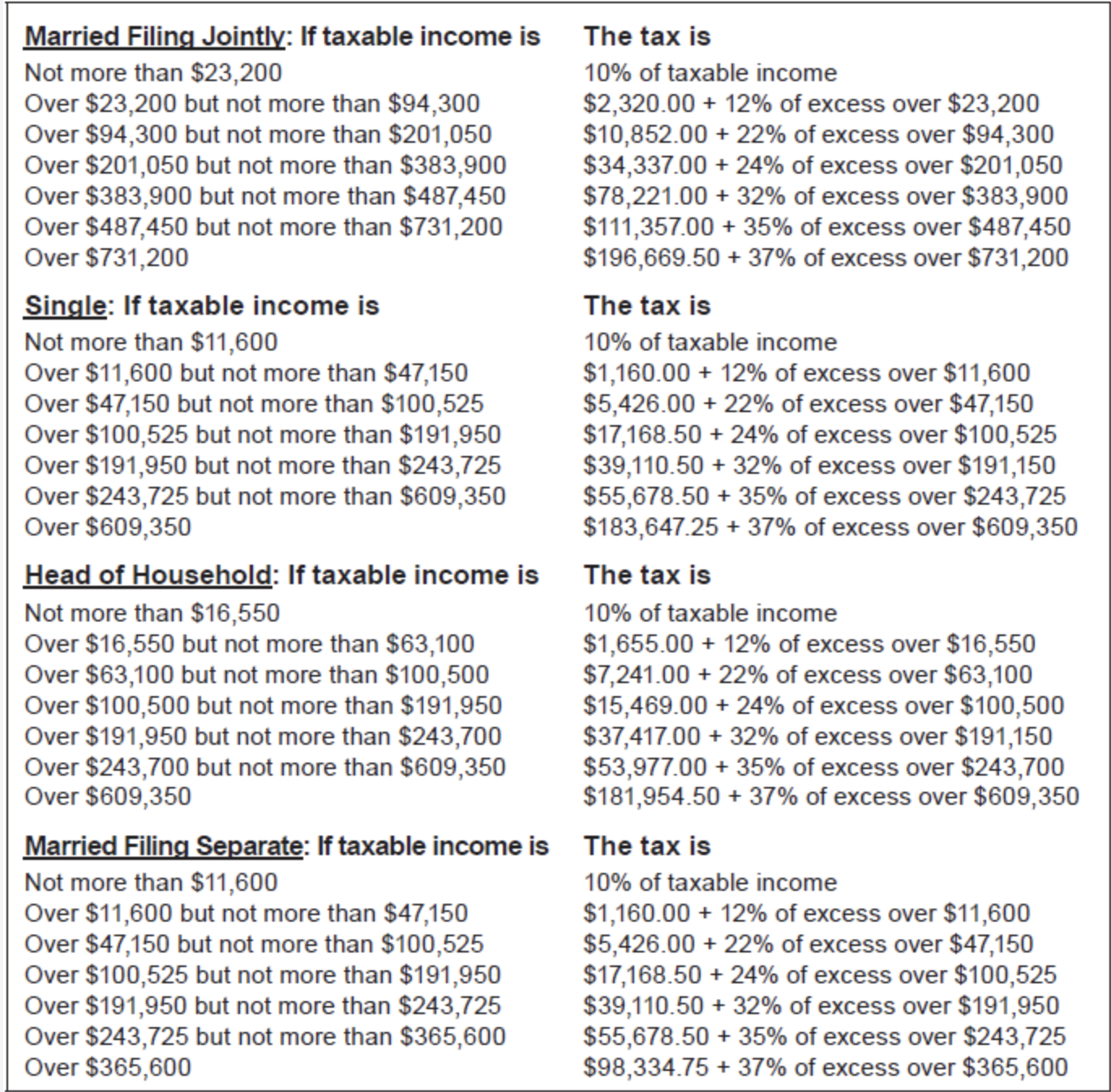

TAX BRACKETS

The income tax brackets for individuals are much wider for 2024 because of inflation during the 2023 fiscal year. Tax rates are unchanged.

STANDARD DEDUCTIONS

Standard deductions are higher for 2024. Married couples get $29,200, plus $1,550 for each spouse 65 or older. Singles can claim $14,600…$16,550 if age 65 or up. Heads of household get $21,900 plus $1,950 once they reach 65. Blind people receive $1,550 more ($1,950 if unmarried and not a surviving spouse).

CAPITAL GAINS

Tax rates on long-term capital gains and qualified dividends do not change.

But the income thresholds to qualify for the various rates go up for 2024. The 0% rate applies at taxable incomes up to $94,050 for joint filers, $63,000 for household heads and $47,025 for singles. The 20% rate starts at $583,751 for joint filers, $551,351 for household heads and $518,901 for single filers. The 15% rate is for filers with taxable incomes between the 0% and 20% break points.

MINIMUM TAX

AMT exemptions rise for 2024 to $133,300 for couples and $85,700 for singles and household heads. The exemption phaseout zones start at $1,218,700 for couples and $609,350 for others. The 28% AMT rate kicks in above $232,600.

KIDDIE TAX

The kiddie tax has less bite in 2024. The first $1,300 of unearned income of a child under age 19…under age 24 if a full-time student…is tax-free. The next $1,300 is taxed at the child’s rate. Any excess is taxed at the parent’s rate.